What’s behind the biggest rise in US home construction starts in 30 years?

21 June 2023

Aerial view of new streets, homes and graded lots near Los Angeles, California (Image: trekandphoto via AdobeStock - stock.adobe.com)

Aerial view of new streets, homes and graded lots near Los Angeles, California (Image: trekandphoto via AdobeStock - stock.adobe.com)

The number of single-family homebuilding projects breaking ground rose to the highest level in more than three decades in May, according to official figures released earlier this week.

Housing starts rose to a seasonally adjusted rate of 1.631 million units, up from a revised figure of 1.34 million in April, according to the US Commerce Department.

The 291,000 increase in starts was the biggest since January 1990, while May’s rate of starts was the second highest since 2006.

So what was behind the sharp increase and can it continue?

The US Federal Reserve last week skipped a rise in interest rates this month, for the first time since early 2022.

That led some to suggest that the housing market may be starting to turn a corner.

But the Federal Open Market Committee, in keeping its policy rate in a range between 5% and 5.25% last week, also signalled that it is likely to hike rates by 25 basis points at least twice before the end of the year, which suggest rates could peak at 5.75% before the end of 2023 amid further fiscal tightening.

Meanwhile, economists also noted that multifamily construction projects that had secured financing last year contributed to gains in May. Those gains could level off later in the year as new financing becomes harder to come by, they warned.

Nonetheless, the figures suggested that builders were “broadly expanding operations” this summer at least, according to Nationwide senior economist Ben Ayers.

Starts rise by double-digit margins in the South, Midwest and West in May, although they declined by nearly 19% in the Northeast. Single-family starts were up 18.5%.

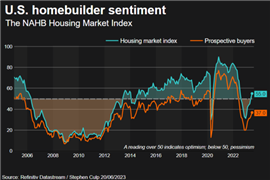

The National Association of Home Builders/Wells Fargo Housing Market Index in June was also positive for the first time since July 2022.

Image: NAHB

Image: NAHB

But NAHB chairman Alicia Huey noted that tougher credit conditions could make it harder for builders to access funding for new projects.

“Access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot suppliers as the industry tries to expand off cycle lows,” Huey said.

And Jeffries US economist Thomas Simons said that the strength of the rise in new starts was “so far off trend” that it called the sustainability of the turnaround into question, noting that the 67% surge in starts in the Midwest may be as a result of one-off rebuilding efforts following the spring tornado season.

China drops rates, UK risks becoming inflation outlier

Meanwhile, the People’s Bank of China cut two benchmark lending rates earlier this week – its one-year and five-year loan prime rates, by 10 basis points each to 3.55% and 4.2% respectively.

China’s economy is running behind its 2023 gross domestic product growth target of around 5%, growing at about 4.5% year on year, according to S&P Global.

Analysts expect the country to cut lending rates further to boost growth in its economy, including in its spluttering housing market, which stalled amid Covid-19 lockdowns before showing signs of a rebound earlier this year.

And in the UK, the Bank of England was widely expected to increase interest rates once again this Thursday.

The expected rate rise came as news emerged on Wednesday of stubbornly high inflation, which remained at 8.7% in May, despite expectations that it would fall. The closest comparable US inflation measure is closer to 3%, while in France and Germany it sits at around 6%, putting the UK in danger of becoming an inflation outlier.

A survey of UK construction buyers earlier this month reported the fastest increase in construction activity for three months in May, driven largely by faster rises in commercial building and civil engineering activity.

But the S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) also pointed to the steepest falls in house building since May 2020, amid worries about the impact of higher rates and subdued market conditions – something that further rate rises to control inflation are unlikely to help.

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), said, “The residential sub-sector is closely linked to consumer confidence and levels of spending. A further hike in interest rates is expected this month, and along with the relentless increase in the cost of living is making buyers hesitate about purchasing homes. As a result, builder confidence was pinched to remain below the survey average, as business costs remained high and firms expanded their workforce numbers at only a modest pace as they were cautious about their own affordability rates.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM