ABC’s ‘Backlog Indicator’ up, material prices down

15 December 2023

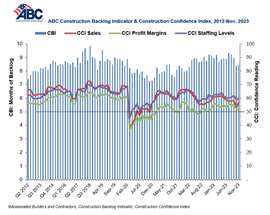

ABC’s Construction Backlog Indicator & Construction Confidence Index from 2012 to November 2023.

ABC’s Construction Backlog Indicator & Construction Confidence Index from 2012 to November 2023.

Commodity prices have decreased as construction backlogs increased in the US construction market, according to the latest report from the Associated Builders and Contractors (ABC). The organisation revealed that its Construction Backlog Indicator moved up to 8.5 months in November from 8.4 months in October.

Along with an increase in backlog, construction input prices decreased 0.3% in November compared to the previous month, according to ABC’s analysis of the US Bureau of Labor Statistics’ Producer Price Index. Non-residential construction input prices decreased 0.3% for the month, as well.

Despite the year-end dip in prices, inputs to construction are still roughly 39% higher than at the start of the Covid-19 pandemic. The backlog reading, too, is down 0.7 months from last year at this time and is 0.8 months lower than July 2023’s cyclical peak.

“A growing number of contractors are reporting declines in backlog,” acknowledged ABC Chief Economist Anirban Basu, adding that tightening credit conditions and interest rate hikes in the US have made project financing challenging.

The sharpest declines in backlog over the timeframe occurred among contractors with more than $100 million in annual revenues. Those contractors collectively reported fewer than ten months of backlog in November for the first time since the second quarter of 2018.

US interest rates

“The good news is that certain interest rates have begun to fall in anticipation of [US] Federal Reserve rate cuts next year, perhaps as early as the first quarter,” added Basu. “Still, 2024 is poised to be weaker from a construction demand perspective for many firms, especially those that depend heavily on private developers.

“Those operating in public construction and/or industrial segments should meet with less resistance on average,” he said.

The US Federal Reserve announced a pause in rate hikes on December 13 with an expectation to cut interest rates through 2024. The Federal Reserve began a series of aggressive rate hikes in March 2022. In total, rates were increased nine times between then and through July 26, 2023.

Basu addressed the pause in increased rates in real-time during an ABC webinar – titled Construction Executive’s 2024 Construction Economic Update and Forecast – also held on December 13.

“Whenever this [interest] rate is established at a high level, banks are less likely to… lend aggressively to the economy,” he said.

He added that, for the first time in nearly three years, the Federal Reserve is expected to cut rates in 2024. The Fed cut rates to 0.0% in March 2020 in response to economic conditions exasperated by the Covid-19 pandemic.

As for prices, Basu credited record oil production as a main catalyst for change but noted decreases in pricing have been witnessed across several commodities.

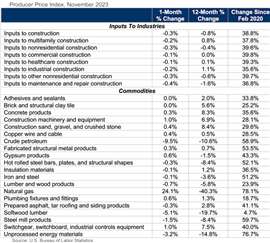

The US Bureau of Labor Statistics’ Producer Price Index for November 2023.

The US Bureau of Labor Statistics’ Producer Price Index for November 2023.

“While much of the recent decline is due to record domestic oil production and the resulting precipitous decline in gas and diesel prices, other commodities like iron and steel and lumber products are currently more affordable than they were at the same time last year,” he said.

Overall construction input prices are 0.8% lower than a year ago, while nonresidential construction input prices are 0.4% lower.

Prices decreased in two of the three energy subcategories last month. Crude petroleum input prices were down 9.5%, while unprocessed energy materials prices were down 3.2%. Natural gas prices rose 24.1% in November.

Decreasing input prices

Basu noted that decreasing input prices, or at least some stability, should benefit the industry in the short term.

“Falling, or at the very least stable, input prices should help to control construction cost increases in the coming quarters,” said Basu. “This is a welcome development for an industry still dealing with extraordinarily elevated financing costs and rising labors costs due to ongoing worker shortages.”

Basu added, at the December 13 webinar, that supply chain improvements have also been a big boon to the industry over the past 21 months.

“Supply chains are much more fully operational than late 2021,” he said. “As supply chains improve, you get more transactional volume because that demand is waiting for that supply.

“You also get less inflation,” he added, stating an inflation rate closer to the Federal Reserves’ goal of 2% would lead to “solid economic growth.”

The US consumer price index showed inflation running at roughly 3.1% between November 2022 and November 2023. Compared against June 2022’s high rate of 9%, Basu added, “the trend is quite striking. It is wonderful news,” he said.

ABC’s Construction Confidence Index readings for sales and staffing levels also increased in November, while the reading for profit margins fell. All three readings remain above the threshold of 50, which indicates expectations for growth over the next six months.

The US Bureau of Labor Statistics’ graph tracking percentage change to inputs in the construction industry from November 2017 to November 2023.

The US Bureau of Labor Statistics’ graph tracking percentage change to inputs in the construction industry from November 2017 to November 2023.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM