Who’s buying construction equipment?

30 November 2021

The UK construction equipment market is unique in Europe, and indeed the world, for the very high proportion of machines sold to plant hire firms.

According to new data from specialist market research and forecasting company, Off-Highway Research, the UK construction equipment market is unique in Europe - and indeed the world - for the high amount of units purchased by the rental sector.

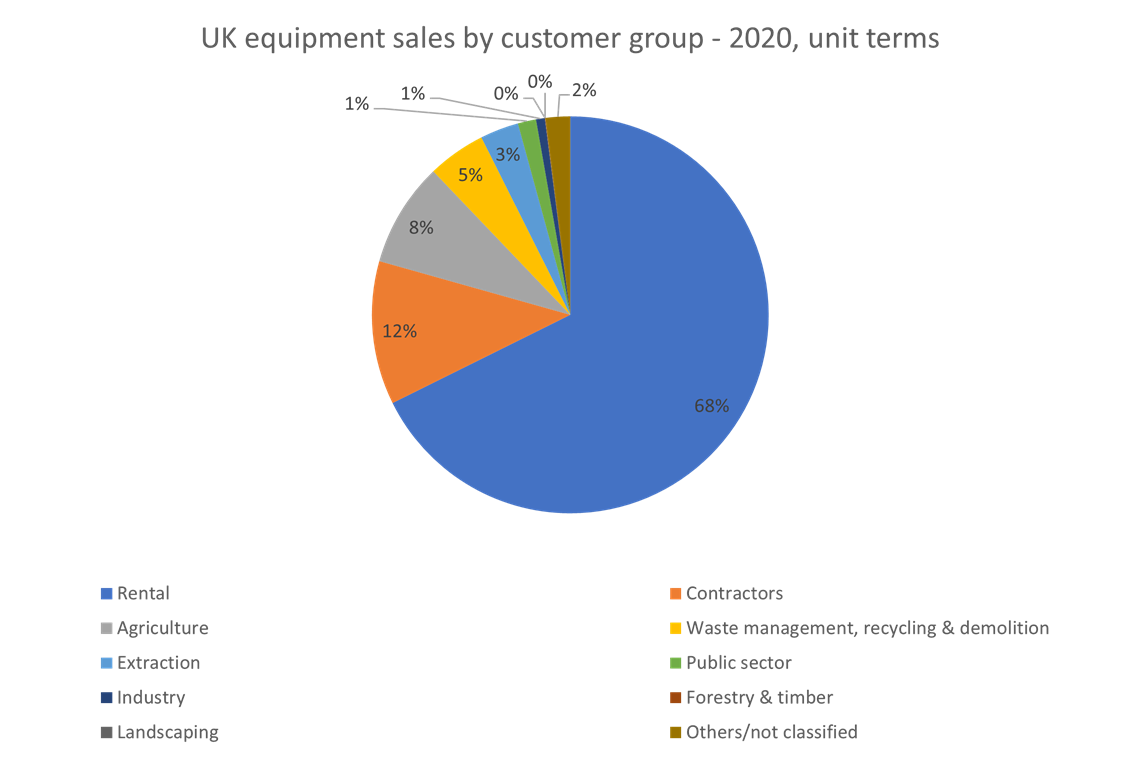

The company’s latest research has found that plant hire firms accounted for a massive 68% of sales in unit terms in 2020 and an estimated 54% of the total value of equipment sold.

This was across the 15 key types of construction equipment covered by Off-Highway Research, including excavators, wheeled loaders, telehandlers and larger equipment types such as dozers, graders and dump trucks.

Off-Highway Research believes this gives plant hire a uniquely high penetration in the UK, compared not only to other European countries, but to anywhere else in the world.

Managing Director Chris Sleight said, “If you look at other as the US, Japan, or France, you see the proportion of equipment sales to rental companies around the 30-40%.

“They would be considered to be mature rental markets, so clearly the UK is in a different league when it comes to the relative size and influence of the plant hire industry.”

Given that plant hire represents such a big slice overall sales, it will come as no surprise that the industry is the biggest buyer of most of the individual equipment types, particularly high volume machines like mini excavators, crawler excavators and telehandlers.

It is only relatively specialised machine types such as asphalt pavers and rigid dump trucks where rental does not dominate.

The other major buyer groups are contractors, which represented 12% of unit sales in 2020, agriculture (9%), waste management, demolition & recycling (5%) and mining/quarrying (3%).

However, looking at these splits in terms of the estimated value of equipment bought shows that contractors are still the second largest group in value terms, accounting for about 15% of the market.

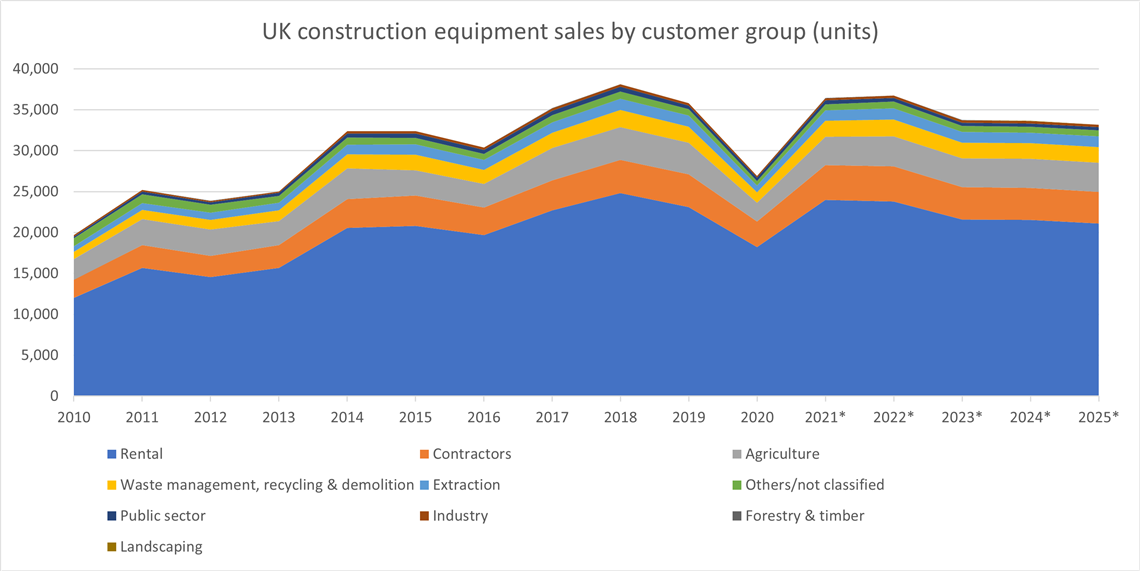

Overall, the relative split of sales by customer groups in the UK has remained little changed over the last decade. However, there are some areas where a small shift is noticeable.

“A greater proportion of the crawler excavators sold in the UK are going into plant hire than was the case a decade ago and even bigger machines like crawler dozers are finding more room in rental fleets,” said Off-Highway Research.

The only major area where plant hire does not seem to be increasing its share of equipment purchases is wheeled loaders - where agriculture is the most important segment for smaller machines.

While Off-Highway Research’s forecast to 2025 does not anticipate any major change in the structure of the market in terms of the share held by different buyer groups, it said, “the only moderate change which might be picked out of the forecast is the potential for growth in the water management, recycling and demolition segments”.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM