UK construction sector growth eases

07 January 2022

Growth in the UK’s construction sector slowed in the last quarter of 2021, with continuing disruption to supply chain logistics still causing difficulties across the sector, according to research from IHS Markit.

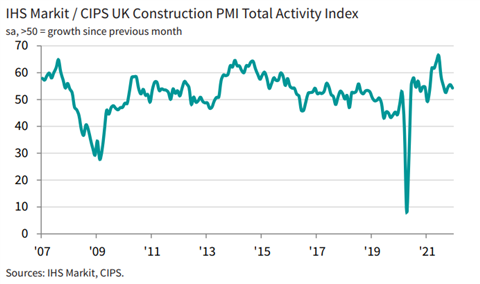

The London-based company’s latest PMI (Purchase Managers’ Index) report revealed that revealed that although the rate of growth in the sector had declined slightly since last September, it still represented “another solid increase in business activity across the UK construction sector”.

Carried out in partnership with the Chartered Institute of Procurement & Supply (CIPS), the PMI report comprises monthly survey data from 150 private sector companies.

Analysis of the survey data revealed a seasonally adjusted UK Construction PMI Total Activity Index figure of 54.3 for December 2021. Although this “reading was down from 55.5 in November and “signalled the weakest rate of expansion for three months”, it was still above the 50.0 no-change threshold.

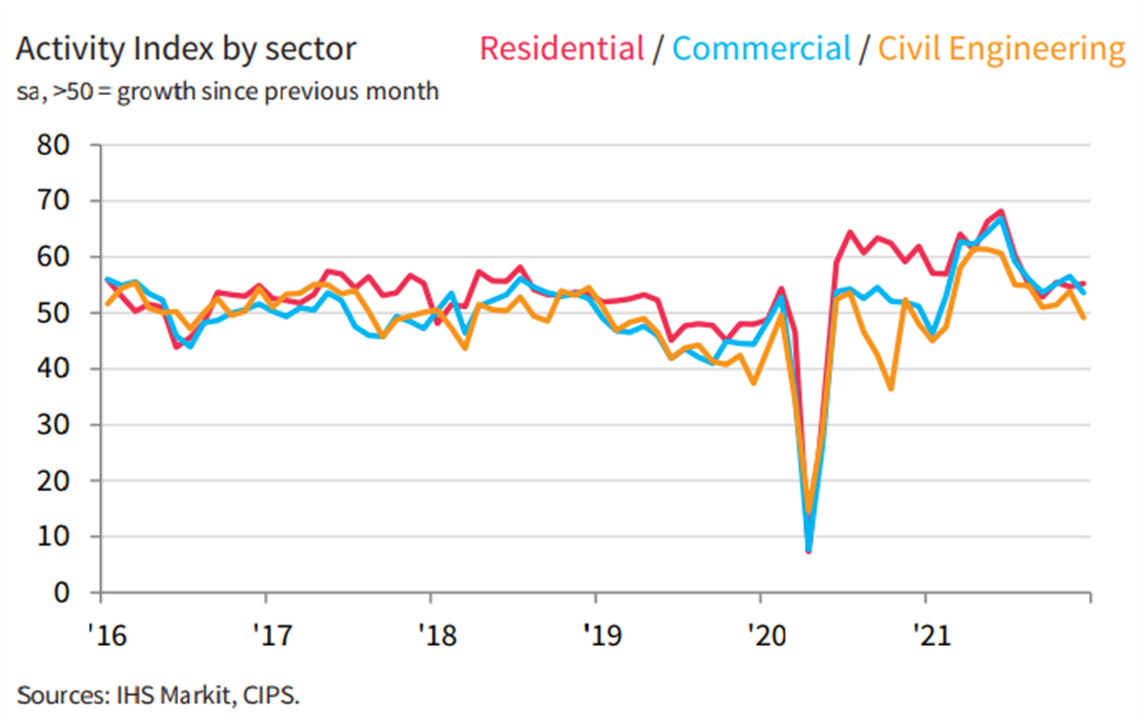

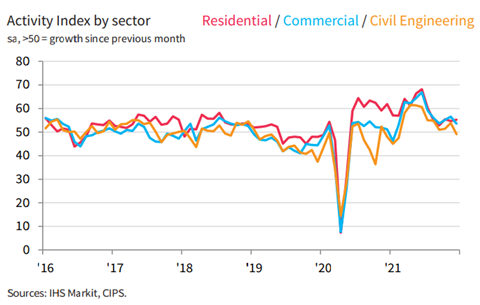

The PMI report said, “Residential construction activity saw the strongest growth (index at 55.3) and was the only category to gain momentum in December. Commercial building lost its position as the best performing segment, with the recovery easing to its lowest since September (index at 53.6).

“Meanwhile, civil engineering activity decreased slightly at the end of 2021 (index at 49.1), which ended a nine-month period of expansion.”

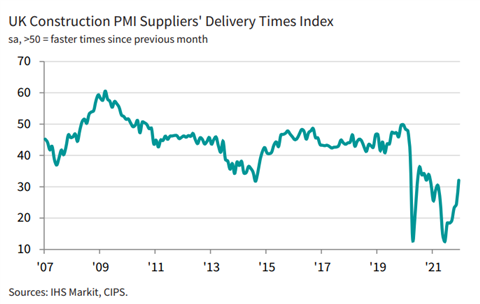

On the positive side of things, the survey data found that construction sector suppliers have now caught up on the backlog of orders.

This indicated that “an improved alignment between demand and supply helped to soften inflationary pressures at the end of 2021,” the report said.

Commenting on the report, Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said, “Though the overall index moved down slightly in December there was light at the end of the tunnel for builders in terms of the strongest order numbers since August, reduced pressure on business costs and some improved delivery times for essential materials.”

While the survey report also found that 51% of companies were expecting business to increase in 2022 and just 9% were predicting a decline, this ‘optimism was the joint-lowest reported since January 2021”.

The ongoing uncertainty surrounding the Omicron variant of Covid-19, rising costs and continuing transport issues were found to be the main causes of concern for construction sector firms.

“It was shipping delays and haulage shortages that remained the significant gripes in the industry as over a third of supply chain managers faced longer wait times,” said Brock.

“Though this was an improvement on the previous month and the best since November 2020, it was still a factor affecting builders’ forecasts for 2022 as business optimism fell to the joint-lowest for almost a year.”

Tim Moore, Director at IHS Markit, added that while the worst of the supply chain delays seemed to have passed, “some firms commented on disruption from rising COVID-19 cases, while others noted a lack of new work to sustain the rapid growth rates seen earlier in 2021.”

According to the PMI report, some respondents said they thought the increase in Covid-19 cases and the resulting tightening of pandemic restrictions had hindered the recovery of businesses.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM