Research shows “falling optimism” in UK construction

08 April 2022

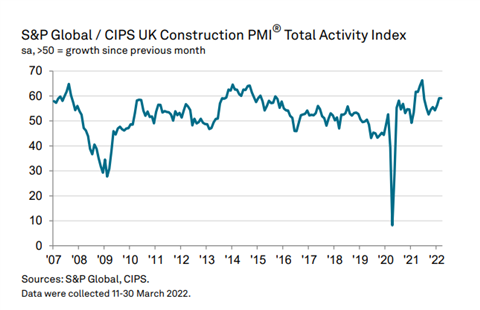

The continued rise in UK construction output is masking “falling optimism” and a drop in residential construction activity, according to the latest Purchase Managers’ Index (PMI) survey.

Carried out by S&P Global and the Chartered Institute of Procurement & Supply (CIPS), the survey found that as a result of the fastest increase in new work for seven months, the sector has seen a significant boost within the UK.

Tim Moore, Economics Director at S&P Global, said, “Commercial projects helped keep construction growth at its highest level since last summer as clients boosted spending in response to the roll back of pandemic restrictions.

“Civil engineering also fared well in March as work on major infrastructure contracts underpinned growth. Residential work found itself in the slow lane, however, as some firms noted that greater caution crept into spending decisions.”

However, it has also highlighted concerns surrounding the financial implications of the war in Ukraine, which has consequently contributed towards a sharp drop in business optimism.

Commenting on the findings, Brian Berry, Chief Executive of the FMB, said, “Construction output has been sustained during March through the buoyancy of commercial projects, but the latest PMI data makes clear that growth in the repair, maintenance, and improvement (RMI) and house building sectors has stalled.

Berry added, “For smaller construction firms, these projects represent the bread and butter for their businesses. Faced with rampant inflationary pressures and significant uncertainty regarding the economic impact of the war in Ukraine, it’s clear that these smaller building firms look set to suffer at a time when consumers are tightening their belts.”

Aside from the war, forecasts of severe cost inflation and a less favourable global economic outlook all weighed on constructors’ confidence in March, with around 48% of the survey panel expecting a rise in business activity during the year ahead, while only 15% predict a decline. However, the balance of positive sentiment was the weakest seen since October 2020.

Despite that, the survey also highlighted some positives. For example, commercial work within the sector has seen output growth accelerate for three months in a row and the latest upturn was the strongest since June 2021.

Summarising the findings, Moore said, “The construction recovery looks set to continue in the near-term as order books improved at the fastest pace for seven months in March. Input buying and job creation in the sector also remained indicative of strong underlying momentum.

“Escalating fuel, energy and commodity prices led to the fastest rise in costs for six months. Intense inflationary pressures appear to have unnerved some construction companies.

“Business optimism slipped to its lowest since October 2020 on concerns that clients will cut back spending in response to rising prices and heightened economic uncertainty.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM