CECE market analysis highlights cautious optimism in European equipment sector

02 March 2023

In its first Market Update of 2022, the Committee for European Construction Equipment (CECE) described an overall flat market – which, it said, should be seen as a success, given limiting factors, such as the ongoing supply chain issues and the war in Ukraine.

Image: CECE

Image: CECE

A number of the speakers at the online event described the sector as ‘resilient’ and struck a note of cautious optimism for 2023.

CECE’s economic affairs manager, Sebastian Popp, presented an overview of last year’s figures, reporting an average overall decline of 1% across all segments, which he said could be seen as a success.

Ultimately, he said, levels of equipment sales are sitting close to those of 2007 – immediately before the global financial crisis.

Optimism from stable markets

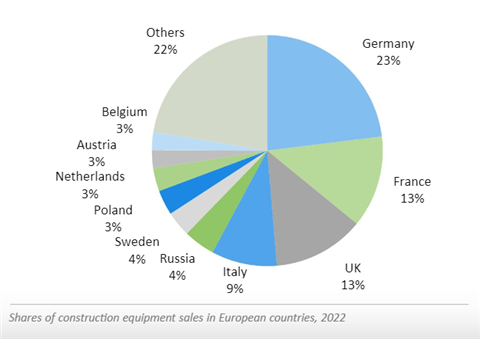

He added that sales within the three largest markets in Europe – Germany, France and the UK – had been relatively stable in 2022, despite the economic and geopolitical uncertainties.

Still from CECE’s Annual Report summary video. Image: CECE

Still from CECE’s Annual Report summary video. Image: CECE

In its report – which also covers rental and mining sectors, as well as giving a global overview – CECE pointed out that, according to European Commission’s latest data, construction output in the EU grew by an average of 0.7% in October and November.

In 2022 as a whole, the highest growth in construction output was seen in Slovenia (44%), Romania (20.4%) and Belgium (12.9%).

By contrast, the largest decreases in output were relatively small, led by Spain (-6.9%), Slovakia (-5.8%) and Germany (-1.2%).

Looking ahead

In terms of its forecast for 2023, CECE said Central and Eastern European markets will likely lose momentum in Q4, which, Popp said, “tells us that this is more a sign that we have seen the peak here”.

The CECE update references a recent report from the market forecasting group Euroconstruct, which examines the construction markets of 19 European countries, said construction companies must expect two difficult years, with growth forecast at just 0.2% in 2023 and 0% in 2024, before growth returns in 2025.

On a more positive note, CECE secretary-general Riccardo Viaggi said the CECE Barometer survey, which measures market confidence, demonstrated an “almost unexpected” level of optimism for the year ahead.

Image: CECE

Image: CECE

“We can look at this as some sort of Bauma effect,” he said, referring to the world’s largest construction trade fair, recently held in Munich, “but two thirds of respondents are reporting ‘good’ or ‘very good’ conditions”.

He also pointed to a consistency of order intakes, with order books “normalising, which is positive news” and added that survey respondents had reported an improvement in the production time of equipment.

CECE president Alexandre Marchetta, said of the findings, “In 2022 the general economic conditions have changed completely compared to the previous year.

“Against this backdrop, it is remarkable that the construction equipment industry is doing so well, also thanks to full order books.”

He also noted, however, that, “Even if inflation slows as predicted, the ECB’s interest rate hikes and the supply chain difficulties will not be over yet.

“Our situation is far from being normal.”

The full CECE Annual Economic Report can be viewed here.

A short video summarising the findings of the report, can also be viewed here.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM