EIA: Strong LNG exports and higher consumption to push prices higher

10 June 2021

European prices have shown similar trends

Steady growth in liquefied natural gas exports and rising gas consumption outside the power sector are two reasons U.S. natural gas prices are expected to rise abruptly in 2021 from last year, according to recent forecasts from the U.S. Energy Information Administration (EIA).

In its recent Short-Term Energy Outlook, the agency predicted average spot price of gas at Henry Hub would be $3.07/MMBtu for all of 2021, up from $2.03/MMBtu last year. Looking further forward, the EIA said the average gas price would slip a bit, down to $2.93/MMBtu in 2022 as LNG exports slowed and domestic production recovered.

Gas prices are currently on an upward swing, with May averaging $2.91/MMBtu, up from $2.66/MMBtu in April. By 3Q21, the price is expected to reach $2.92/MMBtu.

The EIA expects U.S. consumption of natural gas to average 82.9 Bcf/d in 2021, down 0.5% from the prior year. The agency forecast a decline in demand in part because it expects electric power generators to switch away from gas and towards coal as gas prices rise this year.

Residential and commercial gas consumption will rise by 1.2 Bcf/d from 2020 and industrial consumption to rise by 0.7 Bcf/d from last year. The growth in consumption outside of the power sector stems from greater economic activity and colder winter temperatures in 2021, compared with 2020. Looking forward to 2022, the agency predicted total gas consumption will average 82.8 Bcf/d.

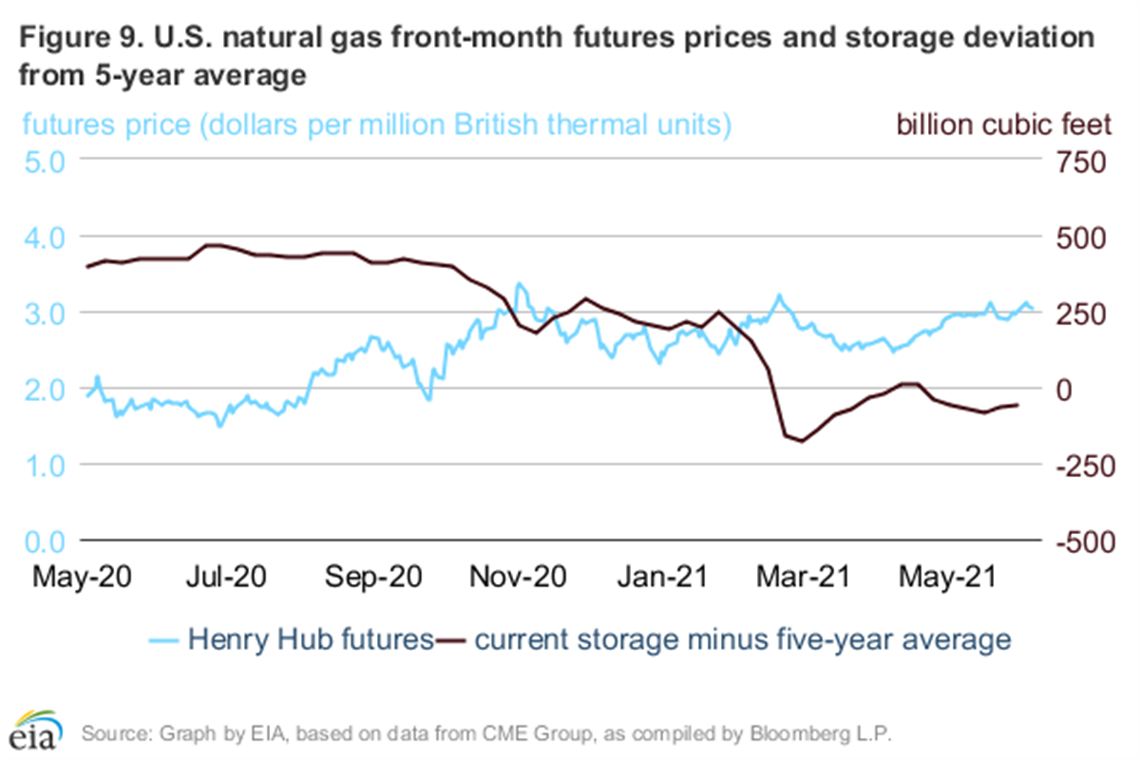

U.S. gas inventories ended May at almost 2.4 Tcf, down 3% from the five-year average. Colder than average temperatures in the winter led to strong withdrawals of gas from storage in the winter of 2020-2021, the EIA reported. The agency forecast that inventories will end the 2021 injection season, essentially the end of October, at 3.6 Tcf, 4% below the five-year average.

Total LNG exports were 10 Bcf/d in May, the most on record for the month. In fact, every month since November has been among the 10 highest months for U.S. LNG exports on record. Storage of gas at the start of the year was above the five-year average, but slipped below that benchmark because of the strong number of LNG exports, the EIA reported.

As stocks have fallen, front-month natural gas futures prices have climbed from $2.58/MMBtu at the start of the year to $3.04/MMBtu on June 3. Although U.S. gas prices have climbed, the volatility of the futures market has fallen, the EIA reported.

Although LNG spot prices often reach yearly lows in May, this year was different. Prices in Asia climbed to levels typically see in the winter. The Japan-Korea Marker price exceeded $10/MMBtu in May, compared with $2/MMBtu last year and $5/MMBtu the year before that. Prices in Asia have risen in response to strong demand as the region attempts to build stocks ahead of the peak demand for summer electricity, the EIA reported.

European prices have shown similar trends as the region experienced the coldest April in nearly a century amid low inventories. Because of the strong global demand for LNG, the EIA forecasts that U.S. LNG exports will continue to be high and average more than 9.0 Bcf/d for the remainder of the year.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM